start again today no. 69: the future of diversity in venture capital, the month behind, the month ahead

Hey 👋🏽,

I started August hoping to learn about the history of venture capital in black owned businesses. Most of the questions I asked led to dead ends.

According to August 2021 Census data, as of 2020, ~12% of the US population identifies as black. 41% of the 1.2K tech industry respondents to Statista’s August 2020 survey said that they were very concerned about the VC funding gap for startups owned by people of color. Their concerns played out. 2020 venture capital funding reached an all time high with $150bn invested. According to Crunchbase, less than 1% (<$1bn) of that $150bn went to companies started by black founders. TechCrunch's analysis painted an even less optimistic picture:

“There are more VC firms that have invested in Black founders than there are Black founders who have raised money from VCs.”

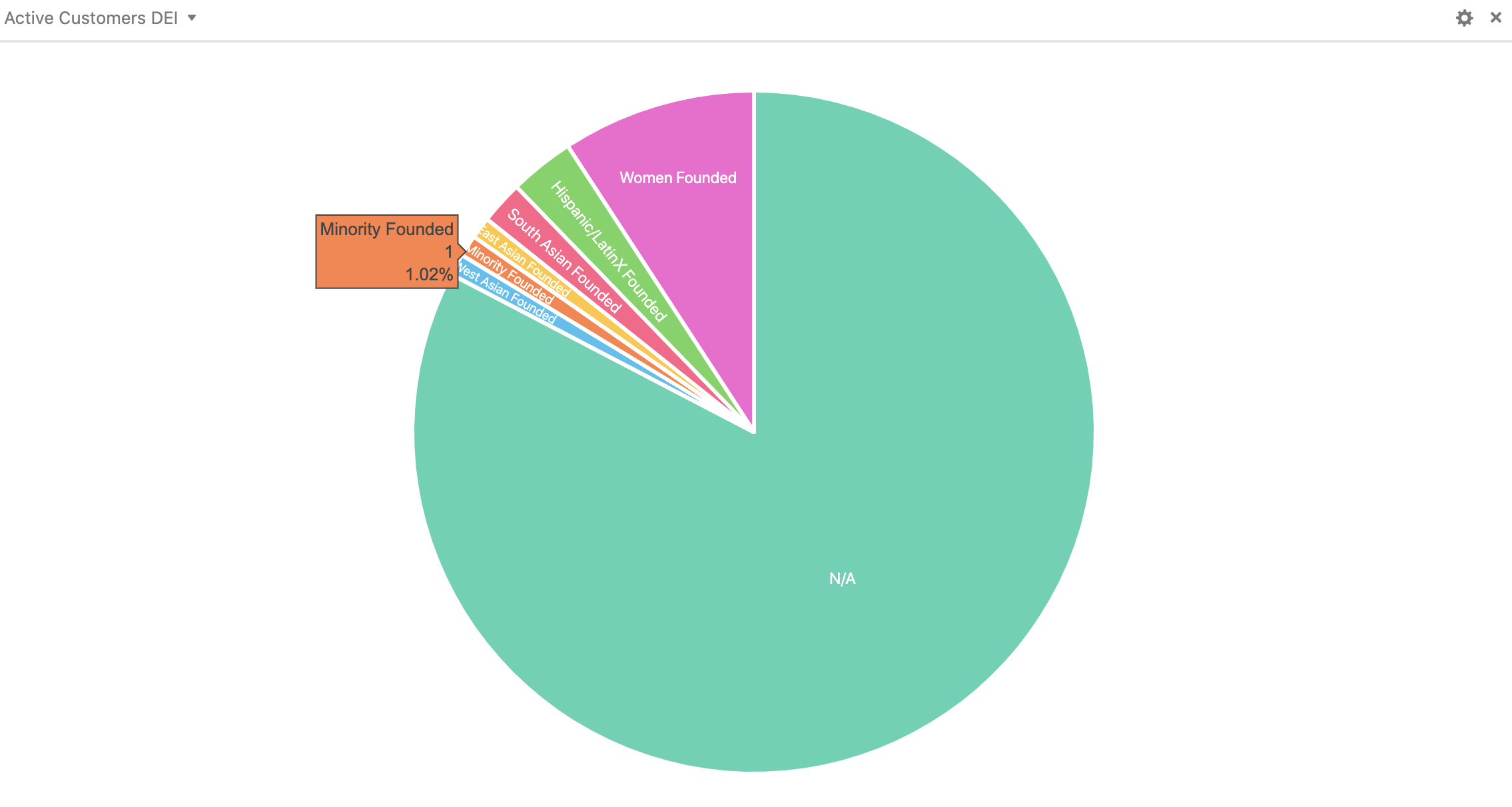

Customer diversity at Animalz reflects the lack of diversity in venture backed startups.

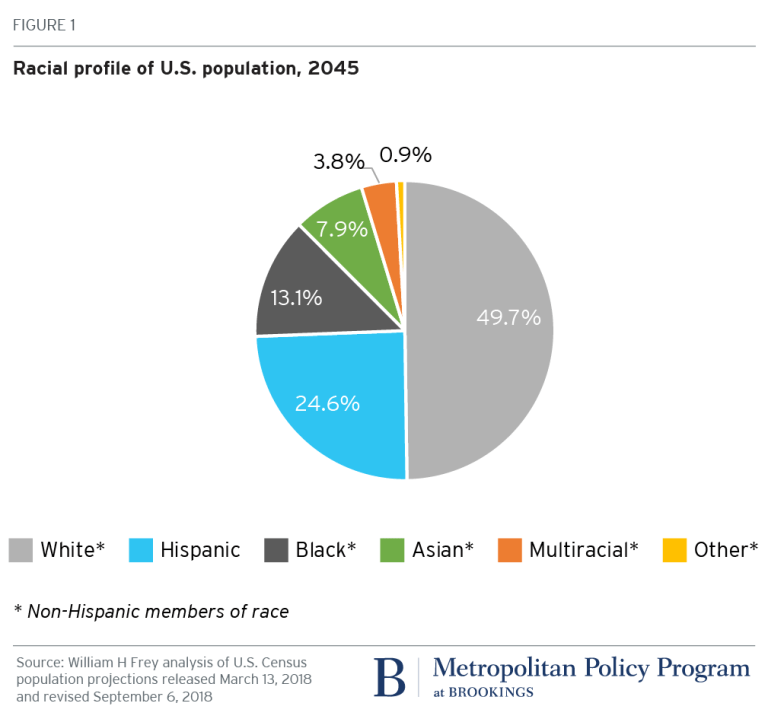

With history in stone, I turned my attention to the future. Census projections predict that by 2045, the majority of the US population will be non-white (this will be true amongst people aged 18-27 in just 6 years!)

The majority of growth will come from racial minorities and international migration by 2030. Venture capital investing currently reflects the past, the status quo. So why are the same types of dudes consistently getting all the capital?

This is the question that launched Hustle Fund, an early stage venture fund built by founders on the premise that great founders can look like anyone. Eric, Shiyan and Elizabeth met at Stanford and launched Hustle Fund 3 years ago to democratize access to capital. Analyzing data from 500 startups, they found no correlation with phenotypes.

The uniting factor between great founding teams is hustle, and inclusivity is a capital lever. So far, their portfolio company founding teams reflect this ethos:

40% women

27% underrepresented groups

60% outside of Silicon Valley

I started angel investing to support founders from and/or supporting underrepresented groups, so immediately fell in love with the Hustle Fund ethos. In July, I joined Hustle Fund's Angel Squad to:

📚 learn

🤝 network

📈 increase deal flow

Since joining, I have gotten to meet incredible founders and investors from all over the world, to learn from the Hustle Fund team as a beginner, and to get access to hot deals that they're excited about.

Our exec coach at Animalz often encourages us to share feedback in terms of:

what's going well

what we'd like to see more of

We can't change the past but we can build the future by thinking super longterm. Starting this month, I'll get to work alongside the Hustle Fund team supporting the Angel Squad community in reaching their angel investing goals.

The pursuit of learning and impact has led me everywhere in my career, and I'm excited to become a better partner to our early stage customers at Animalz and the startup ecosystem by building this community started by Brian Nichols. It also feels like an upstream way to impact the lack of diversity of our current customer base.

If you know anyone who is interested in angel investing (especially women/underrepresented folx), please send them our way/encourage them to apply!

August updates

Ollie started kindergarten…and then 2 days later first grade! Excited to send him off to college in a couple of months 😂 I could die happy today.

My brother, Tucker Bryant, left Google to bring his storytelling talent to founders, senior leaders and teams hoping to inject more creativity into their businesses.

Flow Club graduated from Y Combinator. Ricky CRUSHED his pitch. I’ve learned so much from working with Ricky and David about hustle, focus and prioritization and am so excited to see them continue to grow their online coworking space for founders, investors, builders and creators.

I invested in Sunny Day Fund led by 4x UVA Cavalier Sid Pailla. They were recently featured in WSJ for their work to help companies match emergency savings

We launched a paid content marketing internship at Animalz to help more folx from underrepresented groups break into content marketing. I am SO excited about this and to get to collaborate with our team to design this experience for impact.

Devin and I chatted reflected on growing Animalz and lessons learned over the last year in particular on the Indispensables Podcast.

I started a 30 day challenge tweeting about the resources that have been most helpful to me 11 years of leading teams.

Our exec team got to travel to Maine to watch our VP of People Ops, Nicole Nesman, walk down the aisle! 😍

Goals

I stuck with the 3x/week 7A Reading Flow Clubs

I finished the groundwork for a business dashboard at Animalz, creating a weekly numbers review routine of reviewing ~15 reports and journaling to figure out priorities

While I didn’t learn a ton about the history of venture capital for black owned businesses, I’m very excited for the future! 👆🏽

September Goals

Officially launch our org restructure at Animalz designed to better support our people in delivering the best possible product to our customers.

Design an email drip for Angel Squad members who are new to angel investing to make Hustle Fund team knowledge even more accessible.

Add a weekly thinking in systems Flow Club to dedicate a couple of hours every week to the systems I use to invest.

Finish a writeup on jazz.

Lastly, I’ve been continuously inspired by the following quote over the last month/so. Sharing in case it’s helpful to you:

I see you, I love you, let’s have a great month,

H